Have Money, Will Travel: A Brief Survey of the Mobile Payments Landscape

This page has been archived on the Web

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

Carlisle AdamsFootnote 1

Professor, School of Electrical Engineering and Computer Science, University of Ottawa

June 2013

Disclaimer: The opinions expressed in this report are those of the author and do not necessarily reflect those of the Office of the Privacy Commissioner of Canada.

Abstract

The world of mobile payments is approaching very rapidly and, in some specific environments and use cases, is already here. This report’s purpose is to do a focused examination of mobile payments technology through the lens of security and privacy. The goal is to think about potential security or privacy risks and to consider ways in which these risks can be mitigated, if possible.

This report is divided into three pieces: Context; Analysis; and Recommendations. The first piece looks at the motivations for mobile payments, describes some of the important payment models that have been proposed, introduces the major actors in the mobile payments ecosystem, and traces – at a high level – the flow of money in some of those models.

The second piece looks at the security and privacy risks of some specific payment models. In particular, this part of the report examines the mobile Point-of-Sale (mPOS) model of mobile payments that uses near-field communications (NFC), and also briefly considers the current mobile Commerce (mCommerce) model (as a transition phase toward true mobile payments) and some subcategories of the mobile peer-to-peer (mP2P) and mobile acceptance (mAccept) models.

The third piece looks at how the security and privacy risks of various payment models discussed in Part 2 can be minimized. It includes some recommendations from other sources that are applicable to mobile devices and mobile payments, and proposes some recommendations that arise from the analysis in Part 2 of specific payment models. It also gives recommendations that are relevant generally to all electronic payment models. This latter group of recommendations is categorized according to specific audiences: device and OS manufacturers, mobile network operators, wallet/app developers, standards bodies, merchants, and end users.

Executive Summary

This report examines the mobile payments landscape from the perspective of security and privacy. The first part of the report is intended to set the stage for the two parts that follow; its purpose is to help paint the “big picture”. In particular, it looks briefly at the history of mobile payments and some of the motivations for moving to this technology. It also categorizes mobile payments into four different types: mobile commerce (mCommerce); mobile Point-of-Sale (mPOS); mobile peer-to-peer (mP2P); and mobile payment acceptance (mAccept). Ten different categories of actors in the mobile payments ecosystem are introduced: banks / financial institutions; payment brands; wallet providers; end users; mobile device manufacturers; POS terminal manufacturers; Trusted Service Managers; Mobile Network Operators; Merchants; and Payment Network Operators. Finally, in order to make some of the concepts a bit more concrete, the flow of money is traced in some specific payment models.

Part 2 of the report provides a technical analysis of some mobile payment models. The specific models and technologies examined include online banking / shopping using a mobile browser, mobile carrier billing, near-field communications (NFC), M-Pesa (money transfer using text messaging), MintChip, and Square. This part of the report also provides an analysis of risks and concerns in electronic payments generally (that is, concerns that are applicable to all / many mobile payment models simultaneously). Concerns with respect to security and privacy are presented both in terms of specific technologies and in terms of general electronic transactions. For example, with NFC technology, discussion is presented regarding the possibility of corrupt or malicious readers (skimming attacks), malicious parties on the NFC channel (eavesdropping, relay attacks), and compromised mobile devices (hardware, software, and configuration attacks). Some of the concerns that are common to all / many payment models and technologies may be grouped according to Fair Information Principles:

- Safeguards

- Lack of security implementation (the possibility that not all companies implement available security mechanisms)

- Malicious employees at a payment app company (the need for audit controls, logs, and other technological and procedural mechanisms to control employee access to customer personally-identifiable information)

- Recoverable data after loss or theft (the existence of attacks that can bypass encryption, and the ineffectiveness of some remote wipe mechanisms)

- Natural or man-made disasters (the risk that there may be no non-electronic or alternative storage for backup in the case of an event that disables electronic memory)

- Consent

- Small screens (the difficulty in presenting policies to, and obtaining meaningful consent from, users)

- Accuracy

- Proprietary payment protocols (the risk that such protocols may not be designed or reviewed by security and privacy experts)

- Buggy implementations (the risk that errors may occur in transactions or in stored data)

- Individual access

- Natural or man-made disasters (the risk that users may be unable to access their data, accounts, money, and transaction history following a disastrous event)

The third part of the report provides recommendations that arise from the analysis in Part 2. These recommendations are presented in three sections:

- Relevant recommendations from other sources (including the Federal Trade Commission and the Payment Card Industry)

- Recommendations regarding specific payment technologies (e.g., NFC)

- Recommendations that apply to all / many electronic payment models simultaneously. These are divided into sets that are targeted to specific audiences:

- Device / OS manufacturers

- Mobile Network Operators

- Wallet / payment app developers

- Standards bodies

- Merchants

- End users

It is hoped that this report will be useful to the Office of the Privacy Commissioner of Canada, and to any others that may read it. The purpose of the report is to raise awareness and understanding of a variety of concerns in the mobile payments area so that, over time, they may be addressed by those involved in the creation and use of this technology. The ultimate goal is for all payment systems to be as secure and as privacy-friendly as possible; hopefully this report will make some contribution to concrete progress in that direction.

The recommendations presented are those of the author and are intended to contribute to the privacy and security research of the Office of the Privacy Commissioner of Canada and other interested parties; as such, they should be viewed as input for consideration as the OPC and others formulate their own policies and guidelines in the area of mobile payments.

Have Money, Will Travel:

A Brief Survey of the Mobile Payments Landscape

Part 1 – Setting the Context

Abstract

This first of three parts examines the context for mobile payments, including the various models, actors involved, and money flow in some payment transactions. The overall report focuses on mobile point-of-sale (POS) payments using devices enabled with near-field communications (NFC), although other payment models and technologies are briefly discussed as well.

1. Introduction

The world of mobile payments is approaching very rapidly and, in some specific environments and use cases, is already here. This report’s purpose is to do a focused examination of mobile payments technology through the lens of security and privacy. Thus, there is no explicit goal to dissect legal, policy, usability, governance, business, or even technological feasibility issues, although some of these will inevitably make an appearance in the overall discussion. Rather, the goal is to think about potential security or privacy risks and to consider ways in which these risks can be mitigated, if possible.

This report is divided into three pieces: Context; Analysis; and Recommendations. This first piece looks at the motivations for mobile payments, describes some of the important payment models that have been proposed, introduces the major actors in the mobile payments ecosystem, and traces – at a high level – the flow of money in some of those models. It explores how a transaction starts and ends, and what happens in between, illustrating money flows via use cases with concrete examples.

It is important to begin by noting that “mobile payments” is a large and complex topic; therefore, some limitation of scope is essential. For the purposes of this report, a mobile payment is a monetary transaction involving a mobile device (typically a smart phone) that has an individual user as the initiator or the termination point (or both) of the money flow. As a result, business-to-business (B2B), business-to-government (B2G), and government-to-government (G2G, such as federal-to-provincial transfer payments) transactions are outside this report’s scope. Furthermore, the mobile device must be an essential ingredient in initiating, terminating, or facilitating the payment, and so simply using a browser on a mobile phone to do online banking (paying bills or transferring money from one account to another), or online shopping, is not considered to be a mobile payment (since these transactions can identically be performed using a browser on a PC). Such transactions are therefore not the focus of this report, although they do form an important transition phase toward mobile payments and will be considered briefly in this light.

2. History and Motivation

According to the Task Force for the Payments System ReviewFootnote 2, Canadians currently produce/consume over one billion cheques annually. Large corporations, small and medium enterprises (SMEs), and governments account for approximately 60% of this total, while individuals account for the remaining 40%. Estimated costs per cheque (including invoicing, accounts receivable, accounts payable, cheque processing, postage, handling, and branch/teller costs) range from $1 to $30 depending on the industry segmentFootnote 3.

Ultimately, the cost associated with paper cheques is a primary motivator for digital payment transactions. Potential annual savings by 2020 resulting from replacing a portion of this paper cheque volume with digital payments are estimated between $3B to $7B, or roughly 0.1% to 0.3% of Canada’s GDPFootnote 4. Along with this is the promise of greater convenience and tremendous efficiency increases given that transactions could occur immediately or nearly instantaneously, compared with the several days that it might take a paper cheque to reach its destination via traditional mail.

Another claimed motivator is the perception that Canada lags other countries in moving to digital payments. By some measures (e.g., number of B2B electronic transactions), Canada is seen as trailing (in a few cases, seriously) South Korea, the United States, China, Denmark, Finland, Norway, Sweden, the United Kingdom, Australia, Germany, Spain, Italy, Brazil, and JapanFootnote 5. This is viewed by various Canadian entities as an embarrassment that needs to be rectified as soon as possible. By other measures, however (e.g., percentage of electronic consumer point-of-sale (POS) transactions), Canada is among global leadersFootnote 6. Clearly, mobile payments are a subset of digital payments and, as noted above, this report is concerned only with mobile payments that directly involve the end user (consumer). Thus, Canada’s perceived low place in the “world rankings” cannot be seen in this report as a strong motivating reason for the move to mobile payments (certainly not as strong as the convenience and efficiency arguments). In fact, a recent report by MasterCardFootnote 7 shows that Canada ranks second in the world in the Mobile Payments Readiness Index (MPRI), a scorecard that looks at a variety of factors including consumer readiness, environment, financial services, infrastructure, mobile commerce clusters, and regulationFootnote 8.

Finally, it is also worth noting that the value of mobile payments today is estimated at $13B in the U.S. alone (approximately $10B was estimated in Canada for 2011Footnote 9). The increasing availability of tablets and smart phones across all segments of society is expected by many to increase this value, perhaps to as high as $90B by 2017Footnote 10. This clearly holds promise for great profits for all participants in the mobile payment industry.

3. Types of Mobile Payments

According to a 2010 article by CNETFootnote 11, there are at least four distinguishable types of mobile payments: mobile peer-to-peer (mP2P); mobile Point-of-Sale (mPOS); mobile commerce (mCommerce); and mobile payment acceptance (mAccept). Several of these use (or can use) Near-Field Communications (NFC) as an underlying technology; consequently, NFC-enabled payments will form a focus of this report. NFC is a set of standards for smart phones and similar devices to establish wireless communication with each other by touching them together or bringing them into close proximity (a few centimeters or less)Footnote 12.

A description of each payment type follows below.

- mP2P: This covers transactions between individuals, such as paying the babysitter or loaning/repaying $10 to a friend. Such transactions might use PayPal, text messaging, NFC, or other technologies on each person’s mobile device. In this payment type, neither participant is a registered merchant.

- mPOS: This encompasses more formal transactions between a person and a registered merchant, often at the checkout counter of a bricks-and-mortar store. Individuals use their mobile devices to interact with the POS terminal to purchase goods and services. Such transactions may use an NFC-enabled mobile device to communicate with the POS terminal (e.g., the recently-launched Rogers-CIBC-Blackberry initiativeFootnote 13) or may use a technology other than NFC (e.g., the Starbucks-MasterCard bar code scanning initiativeFootnote 14). Alternatively, a mobile device may interact with a non-traditional POS device (such as a tablet) to complete mPOS transactions without NFC. An interesting example is Square Wallet, which allows users to pay a merchant simply by saying their own name, if the user and the merchant both have the Square Wallet app installed and open on their devices. When the user approaches the checkout counter, the apps communicate and the user’s name and picture appear on the merchant device; by confirming his/her name (and resembling the displayed picture) the user has completed the payment transaction.

- mAccept: This is essentially a blend of mP2P and mPOS. Two individuals are involved in the transaction, but one is a merchant. The transaction may be informal in the sense that the merchant may not be a registered, approved agent (e.g., with MasterCard or Visa). The consumer meanwhile pays with a debit or credit card, made possible by the merchant using a mobile device along with a hardware plug-in attachment that allows it to read and process a payment card. Technologies facilitating such transactions include SquareFootnote 15 and PAYware MobileFootnote 16 (Square is discussed in Section 5.2 below). Note that the Payment Card Industry (PCI) Security Standards Council has issued guidelines for the mAccept payment model; see PCISSCFootnote 17, for example.

- mCommerce: This involves the use of an app or the browser on a mobile device to do online shopping. It includes familiar online shopping environments such as Amazon, eBay, and iTunes. In this category, a mobile device is used but is not essential for the transaction (i.e., the same transaction could be performed on a laptop or desktop computer), and so it is considered to be outside the main focus of this report. It is important to note, however, that the idea of buying things online using a phone instead of a PC plays a role in preparing people for the concept of the phone itself as a payment device. This report, then, will look briefly at this transition phase.

In essence, excluding the mCommerce category, the remaining three mobile payment models can be viewed in the following way. Begin with a traditional physical-store purchase scenario (the customer uses a credit/debit card at a POS terminal), and replace the payer end, the payee end, or both ends with a mobile device:

- under mPOS, the payer’s device replaces a credit/debit card (through the use of a payment app, for example);

- in mAccept the payee’s device replaces a POS terminal (through the use of Square, for example); and

- mPSP comprises mobile devices performing both the payer and payee functions.

These scenarios do not simply bring mobile devices into the payment transaction; they can expand the transaction itself to additional actors and features. For example, replacing a traditional POS terminal with a mobile device has allowed arbitrary individuals to become merchants accepting credit/debit card payments (think of buying lemonade from the roadside stand run by a neighborhood child, or an item from a garage sale or farmer’s market, using MasterCard). As another example, replacing a traditional credit/debit card with a mobile device has allowed the development of electronic wallets (such as Google Wallet) that hold multiple payment instruments, including various debit and credit cards, coupons, loyalty cards, and membership discount cards. Finally, replacing both credit/debit cards and POS terminals with mobile devices has not only allowed simple informal card- or bank-account-based payments between individuals (e.g., via PayPal), but has also provided the impetus for the movement toward digital cash (i.e., coins and bills in electronic form) that can be exchanged just like hard currency between various entities (see MintChipFootnote 18, for example).

As mentioned above, this report will examine the mPOS model of mobile payments (as built around the use of NFC-enabled mobile devices at the payer end), but will also look at some subcategories of the mP2P, mAccept, and mCommerce payment models.

4. The Mobile Payments Ecosystem for the mPOS model

This section gives an overview of the different actors involved in the NFC-enabled mPOS model of mobile payments. The information is based on the following sources: the 2009 white paper by the Smart Card Alliance entitled “Security of Proximity Mobile Payments”Footnote 19; the 2012 Canadian NFC Mobile Payments Reference ModelFootnote 20; and the 2011 CNET article entitled “Who Will Profit from NFC, Mobile Payments?”Footnote 21

4.1 Ten Categories of Actors

There are 10 categories of actors in the NFC mPOS model: four involved primarily in enabling the payment service; two involved primarily (or only) in the payment transaction itself; and the other four involved in both.

Each one is described below.

Involved in both enabling payments and in payment transactions

- Bank / Financial Institution: Much of their role is unchanged from traditional credit / debit card transactions, but the dawn of mobile payments provides the potential for higher revenues. For example, as with credit cards, banks can extend lines of credit to users for mobile payment use. As well, the ability to offer new payment services can boost transaction volumes, extend the bank’s brand, and increase customer loyalty. Banks may also be able to persuade (through convenience and efficiency arguments) merchants who currently use cash and cheques to convert to mobile payment acceptance.

Interestingly, the promise of mobile payments has also enticed non-traditional players to consider acting as banks to increase their profits. One prominent Canadian example is Rogers Communications, Inc., who filed papers in 2011 with the federal government to start a bank (“Rogers Bank / Banque Rogers”)Footnote 22. - Payment Brand: The payment brand (e.g., Visa, MasterCard, American Express), which would typically also play the role of the payment application owner/provider, is responsible for the safety and security of payment credentials. The growing success and acceptance of contactless (i.e., chip-enabled tap-and-pay) credit / debit cards suggests that the transition to NFC-enabled mobile devices may be relatively smooth and painless. Payment brand organizations have the opportunity to appear innovative and attractive to consumers and, like the banks, may benefit financially from persuading merchants to convert to mobile payment acceptance.

In addition, the possibility exists to expand the variety and number of payment brands available to the user. This includes issuers of coupons, loyalty cards, and membership discount cards. Since such items can be used to make a payment, or to reduce the price of an item at the time of purchase, the number of players in the payment brand space becomes virtually limitless: any merchant can easily send a coupon to its list of customers, any group can send a discount card to its list of members, and so on. The disadvantage is that this may significantly raise the level of complexity in securing the payment process (for example, how can the merchant ensure the validity of a coupon it didn’t issue?). - Electronic Wallet Provider: The possibility of multiple payment brands being available to the user has naturally given rise to the concept of an electronic wallet (as an app on the device or as a service on a remote server). If users have credit cards, debit cards, various membership cards, and coupons from different issuers, all on their mobile devices, an application is needed to manage and secure these instruments. The wallet provider supplies an app or service (i.e., the wallet), which is what manages these instruments and interfaces with the payer. Providers of such wallets include Google, IsisFootnote 23, Visa, MasterCard, financial institutions, and other third parties. Although wallets are usually free for consumers, wallet providers may charge merchants a flat fee or a percentage for every successful purchase made through the walletFootnote 24.

- End User: The end user is the consumer of mobile payment and mobile connectivity services. While clearly a critical part of the payment transaction, the end user is also involved in enabling the payment service in the following ways: it requests specific payment brands (although some may come preinstalled on the device) and will initiate requests for the issuance of payment credentials (to allow payment applications to function). The user will typically also make choices regarding mobile network operator, mobile device, electronic wallet provider, financial institution, and merchant.

Involved primarily in enabling the payment service

- Mobile Device Manufacturer: The mobile device manufacturer (e.g., Apple, Blackberry, Nexus) can gain a competitive advantage by building devices that support mobile payments. In particular, this may mean building NFC-enabled mobile devices with a secure element (i.e., a smart card chip for secure storage) that stores the payment application and account information. The number of NFC-enabled smart phones is large and is growing at a rapid rate (see NFCWorldFootnote 25 for a current list).

Innovative mobile applications (including payment) will allow device manufacturers to attract new customers and forge new business relationships, and so this represents a financially attractive opportunity for device manufacturers. - POS Terminal Manufacturer: The point-of-sale terminal manufacturer makes the device that sits by the cash register, on the bus, at the metro stop, and so on. NFC-enabled POS terminals allow payments with a wave of the NFC-enabled mobile device, and the speed and convenience of this transaction is attracting merchants worldwide. VeriFone was an early player, but many others are now profiting from sales of NFC POS terminals.

- Trusted Service Manager: The Trusted Service Manager (TSM) (e.g., Vodafone, Oberthur, Gemalto, Giesecke & Devrient, Telefonica) plays a central and critical role in enabling (i.e., provisioning) mobile payments, although it plays no role at all in the actual payment transaction. In particular, as spelled out in some detail in Section 10 of the Canadian NFC Mobile Payments Reference ModelFootnote 26, financial institutions, payment brands, public transit authorities, retailers, and others who wish to provide a payment, ticketing, or loyalty application to users with NFC-enabled devices, must do so through the TSM. Acting as a single point of contact and security gate controlling who can install payment instruments on the device, the TSM collects the NFC-enabled payment application and personal consumer data (such as name, credit card number, and expiry date, for example) and sends it over the air (via the Mobile Network Operator, MNO) to the secure element on the mobile device. The TSM thus provides secure download and lifecycle management services for NFC payment applications and consumer data.

There are typically strict requirements imposed by payment brands for entities that wish to act as TSMs, including going through security audits before being authorized to process the delivery of payment card data. TSMs need to properly manage the cryptographic keys used to secure the communication between the financial institution and the user’s mobile device.

The TSM represents a new business opportunity in the mobile payments ecosystemFootnote 27. Third parties (such as personalization service providers as used with traditional credit and debit payment cards) may choose to become approved as TSMs and offer their services to financial institutions and MNOs. Alternatively, financial institutions or MNOs may choose to become approved and function as TSMs themselves as a way of enlarging their service offerings and increasing revenues. - Mobile Network Operator: The primary role of the MNO (e.g., Rogers) with respect to mobile payments is to provide the channel through which payment applications and consumer data from financial institutions, payment brands, etc., can be delivered to the secure element (SE) on the device. The MNO is therefore responsible for the integrity of the keys and certificates that will be used to protect communication across its network (using the TLS protocol, for example). When the secure element is owned by the MNO (in particular, when the SE is embedded on the UICC (Universal Integrated Circuit Card, commonly referred to as the Subscriber Identity Module (SIM) card) provided by the MNO to the user, the MNO must also maintain the integrity of the keys that allow access (reading, writing) to the secure element. Note that this does not give the MNO access to consumer data: the MNO uses one key to unlock the SE in order to write data to it, and uses a different key to protect the TLS communication of this data from the payment brand to the SE. The data itself is encrypted by the payment brand before transmission using another key known only to the payment brand (so that only the payment brand’s own payment application can read/modify this data). As an additional role in the overall payment process, the MNO may also offer NFC-enabled devices to its customers.

Typically, MNOs experience some churn rate in their subscriber base and consequently seek applications and services that will allow them to not only attract new customers, but also retain the customers they currently have. Mobile payments have the potential to bring economic benefits in this way, and may also realize increased revenues from new payment-related services, such as text message ads and coupons.

Involved primarily (or only) in the payment transaction itself

- Merchant / Retailer: NFC-enabled mobile payments are attractive to merchants because they use, without modification, the existing contactless card payment infrastructure. As a result, merchants who currently accept such payments have everything in place to immediately accept NFC mobile payments. Contactless card payments have been used worldwide for some time to increase both payment transaction speed (through faster transactions and fewer requirements to handle cash) and customer convenience. NFC-enabled mobile payments inherit these benefits, and additionally have the potential to allow merchants to establish stronger customer relationships and customer loyalty.

NFC-enabled mobile payments also have revenue-generating possibilities that contactless cards lack. For example, merchants, like financial institutions, can offer their customers purchase-related and loyalty services, and can make these gift card and loyalty programs more effective (since a customer’s “payment cards” will always be available in his/her mobile device). Furthermore, paperless receipts (e-receipts, sent to the customer via NFC, e-mail, or SMS) will also always be available on the device, simplifying returns or exchanges. Finally, advanced mobile marketing and promotion programs can deliver context- and location-sensitive messages to customers, influencing their purchase behaviour both inside and outside the store, in hopes of leading to more sales and improved customer loyalty. - Payment Network Operator: Authorization and settlement of mobile payment transactions occurs through the existing financial networks, and payment network operators (such as Interac) play the same role they currently play in traditional credit/debit card transactions. The move to mobile payments does nothing to change the function or operation of these back-end payment-processing networks.

Note that an 11th category of actors can also be mentioned, even though it is not involved in the actual payment process: advertising networks. These actors send ads to users’ mobile devices enticing them to make purchases (“there is a Starbucks two blocks from you”; “Häagen Dazs ice cream is on sale this week”; “customers who have purchased this book often purchase that book”). Such location- and context-based advertising can be the impetus to a purchase, both triggering impulse buying and serving to remind users of a previous buying decision.

In the context of this report, this category is intended to encompass 3rd-party advertisers (who deliver advertising to a large set of people as the primary source of their revenue), as opposed to the merchants/retailers who send ads or recommendation information directly, and perhaps exclusively, to their own customers. The relevance of this category to the report is that some payment models may be “free” for use by the end user, and the wallet or payment credential provider may profit from selling information to 3rd-party advertisers, thus raising potential privacy concerns.

Some of the actors in the payment system ecosystem are shown in the following figure (taken from Figure 1 of the Smart Card Alliance white paperFootnote 28):

Text version

Figure 1. Some of the actors in the mPOS payment system ecosystem

Figure 1 illustrates the entities involved in the collaboration model and shows the flow of information for the issuing financial institution to provision the consumer’s payment account information to the phone and for the consumer to use the phone to make a proximity mobile payment. This model posits collaboration among financial institutions, the MNO, and other stakeholders in the mobile payments ecosystem, including (potentially) a trusted third party who manages the deployment of mobile applications (the trusted service manager, or TSM). In this figure, solid arrows are used to indicate payment related transactions, while outline arrows are used to indicate actions related to the personalization of the application.

Financial institutions prepare the account data, and send the payment account information to a TSM. The TSM delivers the consumer's payment account information over the air (OTA) through the mobile network to the secure element in the mobile phone. Once the payment account is in the phone, the consumer can use the phone as a virtual payment card at merchants who accept contactless credit and debit payments. Payments are processed over the current financial networks with credits and debits to the appropriate accounts.

Figure 1. Some of the actors in the mPOS payment system ecosystem

Not surprisingly, the mPOS mobile payment ecosystem is similar to any other financial ecosystem: everyone wants a “piece of the pie”; everyone wants to make some money (or save some, in the case of the user) in the payment transaction. At one end are users, who have a maximum amount that they are willing to pay for an item (e.g., $3). At the other end are merchants, who have a minimum amount that they must receive in order to cover costs and make a profit (e.g., $2.50). The difference between these two price points is the money that will be split among all the actors in the ecosystem (for example, if the difference is $0.50, perhaps five cents will go to the user (the item is sold for $2.95), 5 cents will go to the merchant (the merchant retains $2.55), and 40 cents will go to the remaining actors).

4.2 Provisioning / Initialization of the Mobile Payment App and Data

In order to perform NFC-enabled mPOS payments, the user must have an NFC-enabled mobile device, a payment application and payment credentials. According to the Canadian Reference ModelFootnote 29, p. 27, the payment application is similar to the application installed in a contactless card (e.g., Visa PayWave and MasterCard PayPass), and the payment credential is the personalized information within this application that is unique to a specific payment product (including the pass code). Typically, the user software would also include an electronic wallet to manage, and provide an interface for, multiple payment applications. Information associated with the payment credential that is viewable by a wallet or other application is the name of the payment network, the card artwork (i.e., logo), the type of payment product (e.g., debit or credit), and a small portion (e.g., the final 3-4 digits) of the credit/debit card account number: making these viewable allows the consumer to identify and select a payment credential at the time of the payment transaction.

Enabling of the payment application and payment credential is initiated by the financial institution, but only after the consumer is ready to begin the process on the mobile device (which might involve the consumer entering a bank-supplied activation code into the handset to initiate the enabling process). As described in the Canadian Reference Model, Section 10, the financial institution provides the app and data to the TSM, which installs the app and data on the secure element on the device (via the wallet, if present, which has access only to the viewable information while all other information is stored solely within the secure element). After this enabling process, the consumer is able to make mobile payment transactions.

5. Other Payment Models

In addition to the model presented above, two other mobile payment models will be briefly discussed in the following sections (and in Part 2 of this report): the mP2P and mAccept models. While these do not currently seem to be as important or prevalent as the NFC mPOS model in Canada, they are examined here because they either have strong proponents or are prevalent in other parts of the world.

5.1 mP2P (Transactions between Individuals)

Peer-to-peer (also known as person-to-person although some have made a distinction; see CharratFootnote 30, for example) payment transactions using mobile devices can be realized using many different underlying technologies. Those that have achieved some prominence include PayPal (using Bump or NFC) and M-Pesa (using SMS text messages); another technology on the horizon is MintChip (using digital cash).

5.1.1 Paypal

PayPal has been operating as a processor for e-commerce payments and money transfers since March 2000Footnote 31. By 2004, PayPal began exploring the use of mobile devices for money transfer (PayPal Mobile) through text messages on cell phonesFootnote 32. By 2010 they had extended their technology to the use of Bump (Bump was subsequently dropped from PayPal, although it is still used by ING and elsewhere), and by late 2011 an Android app was launched that used NFC to transfer money.

Although it looks very much like an NFC transaction, Bump does not use NFC technology. The Bump Pay app recognizes tapping motions and maps them. When a “bump” is recognized, a signal is sent to cloud servers that match it with another “bump” that occurred at the exact same place and time. It decides that those two “bumps” are a match and exchanges information between themFootnote 33. To use the app, Alice connects to her PayPal account, types in the amount she wants to pay, bumps her phone against Bob’s phone, and then confirms the payment. Bob must also have Bump Pay installed in order to receive the payment. If both PayPal accounts are associated with checking accounts, there is no fee for the transfer; otherwise, a few percent will be charged if only a credit card is associatedFootnote 34.

For NFC, PayPal has an app that allows money transfers using a very simple interface. Alice and Bob each need to have an NFC-enabled Android phone and the PayPal app with the Request Money functionality installed. To request money, Alice enters an amount and taps her phone with Bob’s phone. Once Bob receives the request, he enters his password to send moneyFootnote 35. Interestingly, PayPal has recently turned away from NFC, claiming that it is “technology for technology’s sake” and that it doesn’t “address true customer pain points [irritants]”Footnote 36, although mobile payments via NFC-enabled devices (using underlying payment channels other than PayPal, such as “Osaifu-Keitai” (mobile wallet) by DoCoMo) have been widespread for many years in some countries such as Japan and China.

5.1.2 M-Pesa

M-Pesa (mobile money) was launched in Kenya in 2007 and is now used by well over half the Kenyan population to pay bills, wages, and taxis, to shop, and to send money directly to another person’s mobile phone. In Kenya a large percentage of the population does not have access to banking facilities and M-Pesa allows money transfers to take place quickly and easily in this environment. There are approximately 50,000 M-Pesa agents around the country, typically located in small grocery stores and gas stations. Customers go to one of these agents and register with Safaricom, the mobile phone operator. When registered, they can put money onto their phone by giving cash to the agent. The agent holds onto the cash and the money is virtually transferred to the phone. The customer can then, for example, send money to another person using an SMS message; the recipient takes the message to the nearest agent and is given the cash by that agentFootnote 37.

M-Pesa (or a very similar service) is also used in other African countries, including Ivory Coast, Senegal, and Mali, as well as other countries such as AfghanistanFootnote 38. Mobile payment using SMS is also popular in several European countries, many Latin American countries, the United Kingdom, India, and Australia.

5.1.3 MintChip

[Please note that the Royal Canadian Mint has not launched MintChip. This subsection has been developed by reviewing the information published on the Royal Canadian Mint’s MintChip websiteFootnote 39.]

The Royal Canadian Mint, after considering the evolution of currency and payment technologies (particularly in the area of high-volume, low-value payments at the point of sale), has developed MintChipFootnote 40. It sees MintChip as the digital equivalent of coins and bank notes and expects that it will find widespread use for micro-transactions (under $10) and nano-transactions (under $1).

The core of the system is the MintChip “chip”, a secure integrated circuit smartcard which acts as a storage location for the digital cash itself. This chip can be deployed in different ways, leading to at least four different realizations of MintChip that can be available to users.

First, the chip can be implemented in a single-purpose MintChip USB device. This USB device can then be plugged into any PC or laptop to enable online or offline payment transactions. Second, the chip can be implemented in a single-purpose hardware security module (HSM). The HSM is designed for large online merchants and is meant for environments with high transaction rates. Third, and most relevant to this report, the chip can be implemented in a MicroSD card (i.e., a small, portable memory card commonly used with cameras and other devices, but also available on some smart phones) which can easily be inserted into a mobile device to make it “MintChip ready”, and removed at any time when this functionality is no longer required. Finally, a third-party service provider may host a farm of MintChips in the cloud on behalf of its users. Users would need to be authenticated by the service provider before being given access to their MintChips. This architecture enables users to participate in MintChip transactions with a device that does not accommodate a MicroSD card or USB stick, such as an Apple iPhone.

The MintChip ecosystem is intended to emulate the existing coin distribution model: MintChip is created by the Royal Canadian Mint, distributed by a Trusted Broker (see below), and used by consumers and merchants. Consumers buy MintChip value from the Trusted Broker and then transact with merchants or other consumers who use the tool to purchase goods or services, or simply perform money transfers. The MintChip acceptors redeem value at the Trusted Broker, and the Broker will typically also interact with a financial institution to acquire and deposit hard currency, as required.

For the mP2P model, two individuals are involved, each with a MintChip chip on a MicroSD card in their phone (the USB and HSM form factors do not involve a mobile device, and although a mobile device can be used to access a MintChip in the cloud, it is not essential; these three form factors are thus outside the scope of this report). The devices exchange “request” and “value” messages; this exchange can take place using SMS, e-mail, or NFC communication. According to the MintChip website, once the value message is created by the sender using the MintChip app with the sender’s chip, the chip’s balance is decreased by the corresponding value. The sender cannot stop or cancel the transaction after the value message has been created. On receiving the value message, the receiver’s app verifies the validity of the message (by checking a digital signature and an included challenge value). If the message is valid, the receiver’s balance is incremented by the amount specified in the value message.

It is not yet clear who will play the role of the Trusted Broker in the MintChip ecosystem. Possible candidates include banks and Canada Post, but perhaps others will campaign to take on this task as well. Also unclear is how anyone will make money from this payment model. One can guess that the Royal Canadian Mint could conceivably make a profit by selling MintChip value to the Trusted Broker at a premium (e.g., $1.00 of value for a price of $1.02). Further, it seems likely that the Trusted Broker could make a profit by treating MintChip as a different currency and charging exchange rates (“today’s rate: we sell $1.00 of MintChip value for $1.05; we buy $1.00 of MintChip value for $0.97”). However, what will be the eventual monetization of the transactions when the system is actually deployed, and who will be the full set of entities that make money, is still up in the air.

5.2 mAccept

The mAccept payment model replaces the POS terminal at the merchant end of a transaction with a mobile device (while the payer uses a traditional credit card). A small piece of hardware attaches to the mobile device, allowing it to physically accept swipes of a credit card so that independent merchants can process credit card payments anytime and anywhere. One of a handful of technologies that enable this payment model is SquareFootnote 41. A white plastic square (more like a cube) plugs into the headphone jack of an Android or Apple phone. This square has a thin slit running through it, which is where the credit card is swiped. Along with the plastic square is the Square app that runs on the phone to process payments. The merchant may swipe the card, take a picture of the merchandise as a reminder (to both parties) of what was sold, and attach the merchant’s own photo/logo/etc. to remind the payer of who the payee was. The Square app hides the card details so that the payee never sees the credit card number or security code, and e-mails or texts a digital receipt to the payer.

According to the Square websiteFootnote 42, Square charges the merchant 2.75 percent of the total for every card swipe, and 3.5 percent plus 15 cents for transactions made with a manually-entered card number. This is similar to PayPal’s pricing strategy (1.9 – 2.9 percent for each sale, plus 30 cents), and is smaller than the transaction fees charged by some banks. This pricing strategy has been highly successful for PayPal; additionally, with Square there is effectively no restriction on when and where the payment transaction can take place.

6. Tracing the Flow of Money

It may be helpful to consider the flow of money in mobile payment transactions. For illustrative purposes, three concrete examples will be described (the first two using the mPOS model and the third using an mP2P model).

Scenario 1: purchase at a merchant POS terminal

In this scenario, Alice wishes to purchase a coffee and muffin at a local coffee house with her NFC-enabled mobile device. After placing her order, she opens the wallet app on her phone, checks that the default payment instrument (which she has previously chosen to be a MasterCard debit card) is selected, informs the teller that she will be using a MasterCard debit card, and once prompted by the teller, puts her phone near the contactless POS terminal. Because this is deemed to be a “convenience transaction” (i.e., one that is performed frequently and quickly), Alice does not need to do any more than “tap-and-go”; in particular, she does not need to engage in a card verification method (such as entering a pass code). Once the transaction has been approved at the POS terminal, an electronic receipt is created and sent to Alice via e-mail, SMS, or NFC. This last option would require a second tap of the mobile phone to the terminal, but has the advantage of the receipt going directly to the mobile wallet and being stored there, which would be useful for a purchased item that might later be returned).

The convenience transaction rule (i.e., no PIN or pass code) and the electronic receipt issuance are unique to the NFC-enabled technology (see the Canadian Reference ModelFootnote 43, p. 35), but otherwise the transaction is the same as payment with a contactless debit card. Specifically, the underlying flow of money is identical to what happens today.

Scenario 2: loyalty card rewards (after 10 muffin purchases you get a free muffin)

This scenario builds on scenario 1, adding a loyalty card from the coffee house into the picture. In this scenario, the coffee house loyalty card is stored in Alice’s mobile wallet and is transmitted to the POS terminal along with her debit card details when she taps her phone. The merchant system checks/updates Alice’s loyalty points balance and determines whether a price reduction is warranted (i.e., whether the price of the muffin should be subtracted from the total). The payment transaction proceeds as above, and the updated loyalty card is transmitted to Alice’s wallet along with her electronic receipt with the second tap of her phone.

Note that the coupon/loyalty or membership card portion of mobile payments is still relatively new and therefore still somewhat in flux. Thus, there are no standards determining how such transactions will precisely operate. In particular, it is not yet clear whether Alice will need to search manually through her electronic wallet to find the relevant coffee house loyalty card, or whether the card will be found automatically once the merchant information (name, location) has been transmitted to the phone. It is also not clear whether the loyalty card will travel with the debit card details in a single NFC exchange, or whether a second tap will be required. Similarly, the updated loyalty card might travel with the electronic receipt at the conclusion of the transaction, or might require an additional tap. In the near term, it might be that different wallets and different merchants will adopt different practices until some standardized transaction flows emerge.

Scenario 3: money transfer between two friends (“Can I borrow $10?”)

In this scenario Alice wishes to give Bob $10 so that he can purchase a birthday card for his brother. A number of technologies have been deployed (or proposed) for doing this, including Bump Pay (with PayPal or ING Direct, for example), SMS (with M-Pesa, for example), NFC (with PagSeguroFootnote 44 in Brazil, for example), and digital cash (MintChip, for example); some of these transaction flows have already been outlined above (see Section 5.1). At least in North America, however, none of these technologies has yet been very successful, and it is unclear which (if any) will dominate the mP2P payment model in the next few years.

7. Conclusion

This part of the report has looked at the context for mobile payments, including what various models exist, who the major actors in the ecosystem are, and how money flows from sender to receiver in some payment transactions. The focus is on mobile point-of-sale (mPOS) transactions that are enabled by near-field-communications (NFC) technology, although mention is made of other models and technologies as well.

Part 2 of the report will discuss the security and privacy implications of some of these mobile payment models.

Have Money, Will Travel:

A Brief Survey of the Mobile Payments Landscape

Part 2 – Analysis of Some Payment Models

Abstract

This second of three parts provides an analysis of some specific mobile payment models. The analysis focuses on mobile point-of-sale (POS) payments using devices enabled with near-field communications (NFC), although other payment models and technologies are briefly considered as well.

1. Introduction

This report on mobile payments is divided into three pieces: Context; Analysis; and Recommendations. This second piece, Part 2 – Analysis of Some Payment Models, looks at the security and privacy risks of some specific payment models. In particular, this part of the report examines the NFC-enabled mPOS model of mobile payments, but also briefly considers the current mCommerce model (as a transition phase toward true mobile payments) and some subcategories of the mP2P and mAccept models.

The remainder of Part 2 is structured as follows. Section 2 looks at two commonly-used mCommerce payment models (online shopping/banking and mobile carrier billing). Section 3 begins the analysis of true mobile payment models, looking in some detail at the NFC-enabled mPOS model and focusing on the three areas where security and privacy risks lie. Section 4 looks briefly at the mP2P model of money transfers, specifically mentioning M-Pesa and MintChip. Section 5 looks briefly at the mAccept model, using Square`s payment model as a case study example. Section 6 talks in general terms about the risks of financial transactions that take place exclusively in electronic form (this discussion is applicable to all mobile payment models). Finally, Section 7 provides some concluding comments.

2. The Transition Phase: Two mCommerce Payment Models

As mentioned in Part 1 of this report (see Section 3 of Part 1), online banking / shopping is out of scope for this paper because in these transactions, the mobile device is the conduit for conducting the transaction, but is not essential for the transaction. However, it represents an important transition phase in society, getting people comfortable with the idea of making a monetary transaction (i.e., paying a bill or purchasing an item) using a phone instead of a computer.

A second model also fits into the mCommerce category and is worth a brief discussion due to its growing use: mobile carrier payments. In the mobile carrier payment model, the mobile device is more essential (i.e., the user must have a mobile device in order to have a contract with the mobile carrier), but the payment transaction is non-traditional (the user “purchases” an item by requesting that the price of the item be added to the user’s next phone bill). A pre-arranged business agreement between the mobile carrier and the merchant is required for such transactions to take place.

2.1 Online Banking / Shopping using a Mobile Browser to a Website

Online banking and online shopping via a mobile browser on a smart phone or tablet is essentially identical to online banking or shopping using a browser on a laptop or desktop computer (minor modifications might include adaptation to a smaller screen or special web pages designed specifically for mobile devices). The only significant difference is that the transaction may take place anywhere and at any time (simply because the user is more likely to have the device on his/her person than a desktop or even a laptop computer). As mentioned above, however, this scenario gets people used to the idea of paying a bill or making a purchase “using a mobile device” rather than a computer (even if the mechanics of the process, such as entering a credit card number and expiration date on a website form, are the same).

Given that the transaction process is identical, it is not surprising that the security and privacy considerations would be similar: browser vulnerabilities can lead to loss or misuse of data, as well as the possibility of malicious software being downloaded to the device. One mitigating factor (compared with laptops and desktops) is that on some mobile device platforms (Android, for example) apps are partitioned so that one app is unable to see (or corrupt) the processing or data of other apps; this can potentially limit the damage that a browser vulnerability can do. On the other hand, if the downloaded malicious software allows the attacker to escalate privileges (for example, by exploiting the fact that the phone has previously been rooted/jailbroken by the legitimate user in order to remove some built-in restrictions on software download and configurability), then anything on the phone may be vulnerable to theft, modification, or destruction.

2.2 Mobile Carrier Payments

In mobile carrier payment systems, the price of a purchased item is put on the next phone bill. The MNO is thus acting like a credit agency (i.e., the MNO pays the merchant at the time of purchase and retrieves the money from the customer at the next billing cycle) and so no traditional payment instrument (such as a credit / debit card) is used by the customer for the purchase. A growing number of third parties have entered into agreements with carriers to allow this payment method (for example, Google allows Android app purchases to be charged to a customer’s mobile phone bill for supported networksFootnote 45, and BlackBerry World has recently struck a similar dealFootnote 46 with Wind Mobile).

A potential privacy concern with mobile carrier payments is associated with big data and the use of analytics: the MNO will know much more about its customers than without carrier billing (e.g., detailed purchase history and merchants involved) and thus has the potential to purposefully or accidentally misuse that data in some way (such as sharing this information with others for marketing purposes).

Consumer issues extend beyond privacy, however. Another concern with mobile carrier payments is that (at least in the U.S.Footnote 47 and CanadaFootnote 48) there are currently no federal statutory protections regarding consumer disputes about fraudulent or unauthorized charges on mobile carrier bills. Rather, consumers must rely on the terms of their mobile carrier agreements or on the good will of the companies involved when disputes arise (see the FTC Workshop ReportFootnote 49, p. 8. This has led to an escalation of the practice of “cramming” (first identified years ago with the landline billing platformFootnote 50) whereby third parties place fraudulent charges onto consumers’ mobile carrier bills in hopes that the consumers will not notice the charges and will simply pay their monthly bill. FTC Workshop Report recommendations in this area include giving consumers the ability to block all third-party charges on their mobile accounts, and establishing a clear and consistent process for consumers to dispute suspicious charges and obtain reimbursement (p. 8). Other suggestions include getting mobile carriers to “standardize and prominently highlight billing descriptions of third-party charges, in a format that makes clear why the consumer is being billed for a third-party charge, the provider or merchant that placed the charge, and the good or service being provided” (p. 9).

Cramming is a significant concern because many consumers are unaware that third parties can place charges on their mobile bills, and that the third parties can do so even if the consumer has provided no credit card or other payment information (p. 10). Furthermore, such charges may appear on the bill as “service fee”, “service charge”, “other fees”, “voice mail”, “mail server”, “calling plan”, or “membership” (these may be cramming if they were unauthorized or if the cost was misrepresented) and can thus go undetected indefinitelyFootnote 51.

3. The NFC-Enabled mPOS Payment Model

In the NFC-enabled mPOS payment model, the user has a mobile device equipped with a near-field communications chip and one or more installed payment instruments (such as debit or credit card applications, prepaid / loyalty / discount / membership cards, and coupons). The merchant has a contactless Point-of-Sale terminal which allows users to wave or tap their NFC devices to make payment transactions.

Three Possible Attack Locations for NFC Payment Transactions

In an NFC mobile payment there are at least three possible locations for an attack to occur. Two of these are shared with current contactless credit / debit cards: the POS terminal (more generally, the reader) may be corrupted in some way; and the channel between the mobile device and a legitimate reader (i.e., the air space) may be breached in some way. Thirdly, what is different about mobile NFC payments (compared with contactless-card-based NFC payments) is that the device itself may be attacked in multiple ways.

The following subsections will consider the security and privacy implications of each of these locations in turn.

3.1 Corrupted POS Terminal

An NFC-enabled mobile device can act in three different ways. First, it can be an active device (a reader) that sends a radio-frequency (RF) signal to supply electrical power to a passive device (i.e., one without a power source such as a battery) in order to enable that device to respond to messages. This is the mode employed when a phone is held near to an NFC tag on a poster or bulletin board in order to retrieve more information than is given in the text of the poster (such as additional description, pricing information, or a link to a web site).

Second, the mobile device can be a passive device, which receives a signal from an external active reader. This is called “card emulation mode” because the mobile device looks exactly like an ordinary contactless card to the reader (e.g., a POS terminal); this is the mode used for mobile payments.

Finally, both the mobile device and the external device can be active, sending signals to each other. This is the mode used, for example, when two phones are “tapped” to exchange business cards.

In card emulation mode, the mobile device is passive, waiting for a message from an external reader. Such a state can make the device vulnerable because the external reader may be corrupted, or even entirely fake (i.e., not a POS terminal at all, but rather some reader that an attacker has built for his/her own malicious purposes). Such “rogue” readers may send valid-looking messages to the mobile device, causing the device to think that a legitimate payment transaction is occurring and therefore transfer money from the user’s account to the reader. For high-value payments ($50 and higher) an additional verification by the user may be required (even something as simple as pressing an “OK” button) and so it would be difficult for this attack to succeed, but for low-value amounts such as a payment of a few dollars, the verification step may be bypassed (particularly if a default payment credential has been enabled in the wallet).

Low-value attacks with a rogue reader (sometimes referred to as “skimming attacks” because the attacker stands near various people, say on a crowded bus or subway train, and “skims” a few dollars from each) are likely to be possible with NFC-enabled mobile devices because similar attacks (skimming card number and expiry date information) have been demonstrated multiple times for NFC-enabled (i.e., contactless) credit cardsFootnote 52,Footnote 53. Skimming the credit card information from a mobile device (i.e., without completing a payment transaction) is also possible when the device is in card emulation mode and the NFC chip is turned on. (Note that card info skimming does not reveal the 3- or 4-digit number (the CVV) on the back of a credit card, which limits the number of places that the skimmed data can be used for a malicious purchase.) It is much more difficult for an attacker to corrupt the real POS terminal of an actual merchant (even if the attacker is also the merchant!) so that, for example, it displays one amount while charging a slightly higher amount, but such attacks are undoubtedly at least theoretically possible.

Metal-lined security sleeves or cases for credit / debit cards can protect against unintended exchanges with malicious readers, but similar sleeves for mobile devices are not likely to find use since they would interfere with normal phone operation. On the other hand, many NFC-enabled phones deliberately disable the NFC capability when the screen is off in order to give some protection against skimming attacks (a protection mechanism that is unavailable to contactless cards). Note, however, that this practice appears to conflict with the Canadian NFC Mobile Payment Reference Model statement that a default credential allows payments to be initiated even if the device is in standby mode (Reference ModelFootnote 54, p. 26).

A topic somewhat related to the concept of a corrupt reader is that of a corrupt NFC tag. An NFC tag is a passive device that is powered and read by a mobile device running in active mode. As mentioned above, such tags may be used on posters or other public places so that phones can be tapped to obtain additional information (such as a trailer for a movie advertised on the poster). However, there has been recent interest in technology that allows users to write their own tags in order to automate specific functionality or repetitive tasks – the tag essentially contains a list of actions (a script) that will be executed one-by-one on the phoneFootnote 55,Footnote 56. For example, when a typical user leaves work and gets in his/her car to go home, the user might change a number of phone settings, such as disabling Wi-Fi, enabling Bluetooth, setting the ringer type to silent, setting the screen brightness, and launching a particular application. An NFC tag can be created (requiring only a writable tag and an application such as “NFC Task Launcher”) to hold all these instructions; the user can then simply tap his/her phone against the tag and all these actions will be completed automaticallyFootnote 57.

Clearly, if malicious readers can exist then malicious tags can also exist: an attacker can create an NFC tag that holds a script of actions that a user might not otherwise choose, such as turning off some security protections and visiting a web page that exploits a browser bug to give the attacker access to data on the phoneFootnote 58. In the context of mobile payments, an attacker may be able to create a tag that launches the wallet and turns off user verification for high-value payments, for example. This could then be used in conjunction with a rogue reader to skim large dollar amounts from people on a crowded bus or subway.

3.2 Corrupted Channel between Mobile Device and POS Terminal

With Near-Field Communications, messages are being transmitted through the air between a mobile device and a POS terminal. Although the length of the air channel is very short (typically less than 10 cm, and perhaps as low as zero cm if the phone is physically tapped against the reader), some researchers have examined whether it is possible for someone to perform an attack on this channel. The types of attacks that have been investigated include eavesdropping, data corruption, data modification, data insertion, and man-in-the-middle (MITM). At study by KremerFootnote 59 has presented the following conclusions (see also Sections 2.1.2 and 2.2.1 of KerschbergerFootnote 60).

- Eavesdropping on the NFC channel is possible with commercially-available equipment and an attacker of low-to-moderate technical skill, but the quality of the eavesdropped signal will depend on a large number of parameters, including the antenna geometry of both the sender and the attacker, the quality of the attacker’s receiver and signal decoder equipment, the location of the attack (walls, metal, ambient noise, and so on), and the signal power from the sender’s NFC device. In some cases, successful eavesdropping from distances of up to 10 m from an active transmitting device (1 m from a passive device) has been demonstrated.

- Data corruption is relatively easy to perform (with commercially-available equipment and low-to-moderate technical skill) – this is effectively a denial-of-service attack in which the attacker transmits a jamming signal so that the real signal cannot be understood by the legitimate receiver. In a payment transaction, however, it is not clear what benefit an attacker could derive from this.

- Data modification may be possible, depending on the modulation scheme employed between the sender and the receiver (i.e., 100% amplitude shift keying (ASK) or 10% ASK), but requires sophisticated equipment and good technical skill. If 100% ASK is used, the attacker can modify only some bits (a bit of value 1 can be changed to a bit of value 0 but only if this bit is preceded by a bit of value 1; in all other cases the bits are essentially impossible to change). If 10% ASK is used, it is theoretically possible for the attacker to modify any chosen bits (change 0’s to 1’s and vice versa). Note that both modulation schemes (referred to as ISO 14443Footnote 61 Type A and Type B) are in widespread use for NFC payment transactions.

- Data insertion is relatively difficult to perform because it requires a significant amount of luck as well as sophisticated equipment and good technical skill – there is a defined protocol (a set number of specified messages) between the sender and receiver devices and so the attacker will only be able to insert a message if one of the legitimate parties is especially slow to transmit its legitimate message (i.e., if there is an unexpected gap into which the attacker can squeeze his/her fake message). Note that if the legitimate party begins to transmit before the attacker’s message has completed, the two messages will overlap and both will be corrupted.

- In a MITM attack, the attacker is positioned between the sender and receiver in such a way that the sender and receiver think they are talking with each other but in fact all their messages are going through the attacker (who can therefore add, delete, or modify messages at will). In NFC, given the very close proximity of the sender and receiver, as well as the fact that the active device is constantly sending a signal to power the passive device, it is essentially impossible for an attacker to remove sent messages, insert new messages, or modify legitimate messages without detection.

On the topic of eavesdropping, a thesis by BerkesFootnote 62 at University of Waterloo has examined the possibility of learning sensitive information based on a timing analysis of messages sent between a sender and a receiver in an NFC channel, and concluded that such attacks are feasible (given commercially-available equipment and good technical skill). By looking only at the messages sent and received in the contactless communication (and armed with a reasonable knowledge of the instruction set and processor speed of the smart card chip, which can be found in publicly-available specifications), it may be possible to infer what computation is going on inside the chip and perhaps even learn some of the hidden confidential data (such as portions of a private key). Some data in the tamper-resistant Secure Element (SE; see Section 3.3.1.1 below) of a mobile phone might therefore be vulnerable to simple passive eavesdropping of the over-the-air channel.

Tomas Rosa, a Swiss researcher, has demonstrated that such relay attacks are indeed possible using generally available hardware, software, and computing devicesFootnote 63.

The conclusion with respect to NFC channel attacks is that while some attacks are very difficult to perform (perhaps impossible in a practical setting), such as MITM message modification, other attacks can be done fairly easily with commercially-available tools and low-to-moderate technical skills, such as eavesdropping, data corruption, and relay of messages. Even in the easy cases, however, the attacker (or an accomplice) must be physically very close to the victim (typically 0.5 m or less), which can often limit the risk to the user in real-world payment transactions. Note that cryptographic mechanisms such as the encryption of messages can help to protect against eavesdropping, but cannot prevent data corruption or relay attacks.

3.3 Corrupted Mobile Device

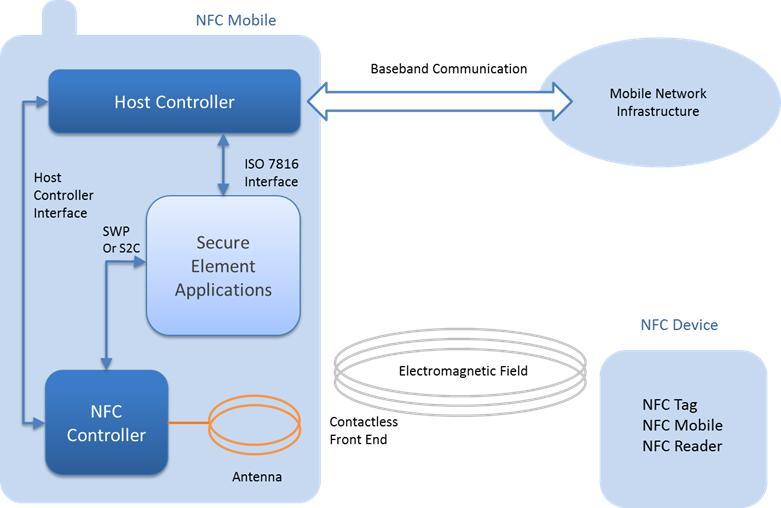

In order to understand some of the security and privacy risks of the NFC-enabled mobile, it is useful to look at the architecture of the payments portion of the device – what the various components are and how they interact. Following that, a description of possible avenues of attack will be given.

3.3.1 NFC Architecture of the Mobile Device

An NFC-enabled mobile device such as a smart phone has a combination of hardware and software that allows payment transactions to be made. The hardware includes an SE chip and an NFC chip, and the software includes a wallet and one or more payment applications (along with associated data).

3.3.1.1 Secure Element

The SE is an essential component for mobile payments. It is a tamper-resistant smart card storage chip (possibly with Common Criteria and FIPS certifications) for holding payment applications and account information. According to ElenkovFootnote 64,

A smart card is essentially a minimalistic computing environment on a single chip, complete with a CPU, ROM, EEPROM, RAM and I/O port. Recent cards also come equipped with cryptographic co-processors implementing common algorithms such as DES, AES and RSA. Smart cards use various techniques to implement tamper resistance, making it quite hard to extract data by disassembling or analyzing the chip. They come pre-programmed with a multi-application OS that takes advantage of the hardware's memory protection features to ensure that each application's data is only available to itself. Application installation and (optionally) access is controlled by requiring the use of cryptographic keys for each operation.

Thus, the SE can hold multiple payment applications and is designed in such a way that the applications are isolated from each other and stored application data cannot easily be extracted by any other party.

The SE is composed of separate Security Domains (SDs) and Supplemental Security Domains (SSDs). A Security Domain is a security context within the SE: it includes a set of cryptographic, communication, and data management operations accessed by unique key material and controlled by a set of specific permissionsFootnote 65. A payment application in the SE requests cryptographic services (such as encryption or decryption, digital signing, or data authentication) through calls to its associated SD. The owner of an SE (a Mobile Network Operator, MNO, for example) manages a set of applications and corresponding SDs on the SE. Additionally, the owner may create and give control of a portion of the SE to another NFC service provider; this portion will contain the service provider’s application and a security context for that application. Such a 3rd-party-controlled security context is referred to as a Supplemental Security Domain (SSD). See Global PlatformFootnote 66 for further discussion of security domains.

Note that the word “owner”, as used in the context of the SE, is not necessarily synonymous with “the accountable party”. The SE owner is the entity that has possession of the SE prior to delivery into the hands of the consumer, and who has the authority to decide which applications and data will be installed on the SE. This, of course, confers on the owner some accountability (e.g., the owner should be responsible for getting the user back to his/her expected level of functionality if the SE stops working or somehow malfunctions and corrupts any stored data). However, if control of a portion of the SE is given to another party (i.e., an SSD) then some accountability must transfer to that party. Complicating things even further, even though the SE owner determines what applications and data can be installed on the SE, the owner does not see any of this data (it is encrypted under a key known only to the application issuer). Thus, accountability for the actual content of the SE data, which may (entirely at the discretion of the application issuer) include consumer personal information, must rest with the application issuer. Therefore, a number of parties may have obligations related to accountability, only one of whom is the SE owner.

Interestingly, there are three possible locations for the SE within a mobile deviceFootnote 67. First, the SE can be embedded in the mobile handset itself. Second, the SE can be implemented on a Universal Integrated Circuit Card (UICC, often referred to as a Subscriber Identity Module (SIM) card). Third, the SE can be implemented on a MicroSD memory card. The first method is conceptually simple (the user purchases an NFC-enabled phone and it comes with an SE that is already in place), but does have at least two disadvantages: the SE (since it should be personal) will need to be registered and personalized after the device has been bought; and if/when the user wishes to change devices, all the SE applications and data will somehow have to be transferred to the new device and the SE of the old device will have to be deactivated (and perhaps all its data securely deleted).

The second and third methods (the UICC SE and the MicroSD SE) have the advantage of portability between mobile devices: if the user wishes to change his/her device all that is required is to remove the UICC or MicroSD from the old device and insert it into the new device. One potential disadvantage of the third method is that not every mobile device has a MicroSD slot, which clearly limits deployment possibilities.

The issue of where the SE is implemented is an important one: it typically defines who owns the SE itself. If the SE is embedded into the handset, then the mobile device manufacturer owns the SE. If the SE is implemented on a UICC, then the MNO (who typically issues the UICC to its customers) is the owner of the SE. Finally, if the SE is implemented on a MicroSD card, then whoever gives/sells the memory card to the user is the owner of the SE (for example, a credit card company or a bank may decide to issue MicroSD cards containing its specific payment application directly to its own customers). Because the owner of the SE controls what payment applications can be installed on it, this question of ownership is of strategic importance to various players in the payment industry since it ultimately determines what payment instruments are available to any given user. As noted above, however, payment industry actors that are interested in being SE owners need to be aware that some level of accountability is an unavoidable part of that same role.

It is not clear that the location of the SE has any specific implications for privacy because the SE owner does not have access to payment application data regardless of where the SE is implemented (the SE owner controls which applications are installed, but application data is seen only by the application issuer). However, there may be slight implications for security. In particular, it may be easier in practice for a UICC or MicroSD to get lost or broken than a mobile device (simply because they are physically so small); on the other hand, it is clear that it would be easier for thieves to steal a phone than to borrow a phone, remove the UICC/MicroSD card, and return the phone without being noticed.

3.3.1.2 NFC Chip